- Task/Client List

- Creating a Client

- Creating a Task

- Creating a Return

- Supplementary Pages

- Submitting to HMRC

- Settings

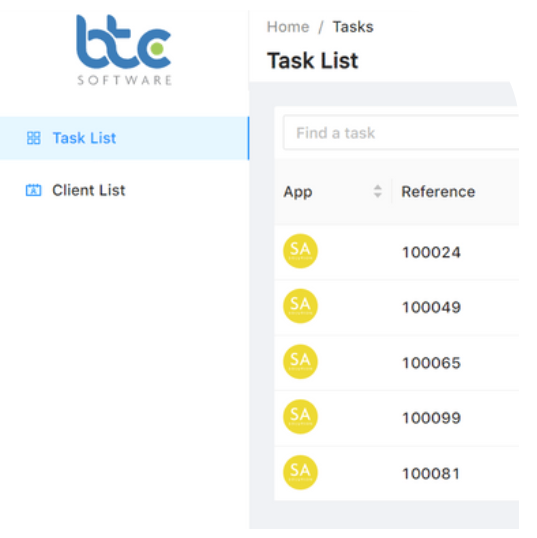

Task/Client List

After logging in, the first page will be your Task List. This will be where any completed and on-going tasks will appear.

You can switch between your Task and Client List using the options on the left hand side.

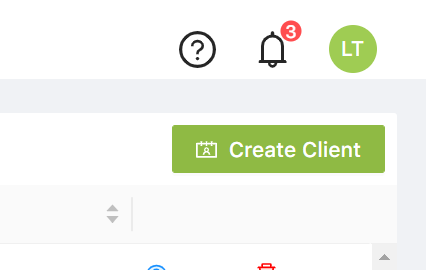

Creating a Client

Creating a client is done by going to the Client List and then select Create Client.

Fields with a red star will need to be filled in before being able to save this client.

Creating a Task

After creating a client, you can back to the Task List and select Create Task.

Select your client from the Client drop down box and select Create Task. This will open a new tab on your web browser for that return.

Creating a Return

Along the top of the ITR are tabs for the Summary, Tax Return, Tax Calculation Summary and Submission History.

Along the bottom is the toggle to set the ITR to edit or read only mode. This is also where you will find options for sending the ITR to the client, to HMRC and to save any changes.

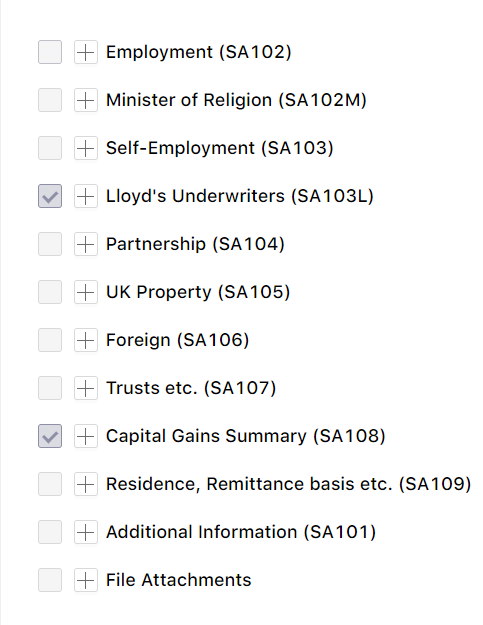

Supplementary Pages

The Supplementary Pages (SA102, SA103 and SA105) can be found on the Summary Tab, under What Makes Up the Tax Return.

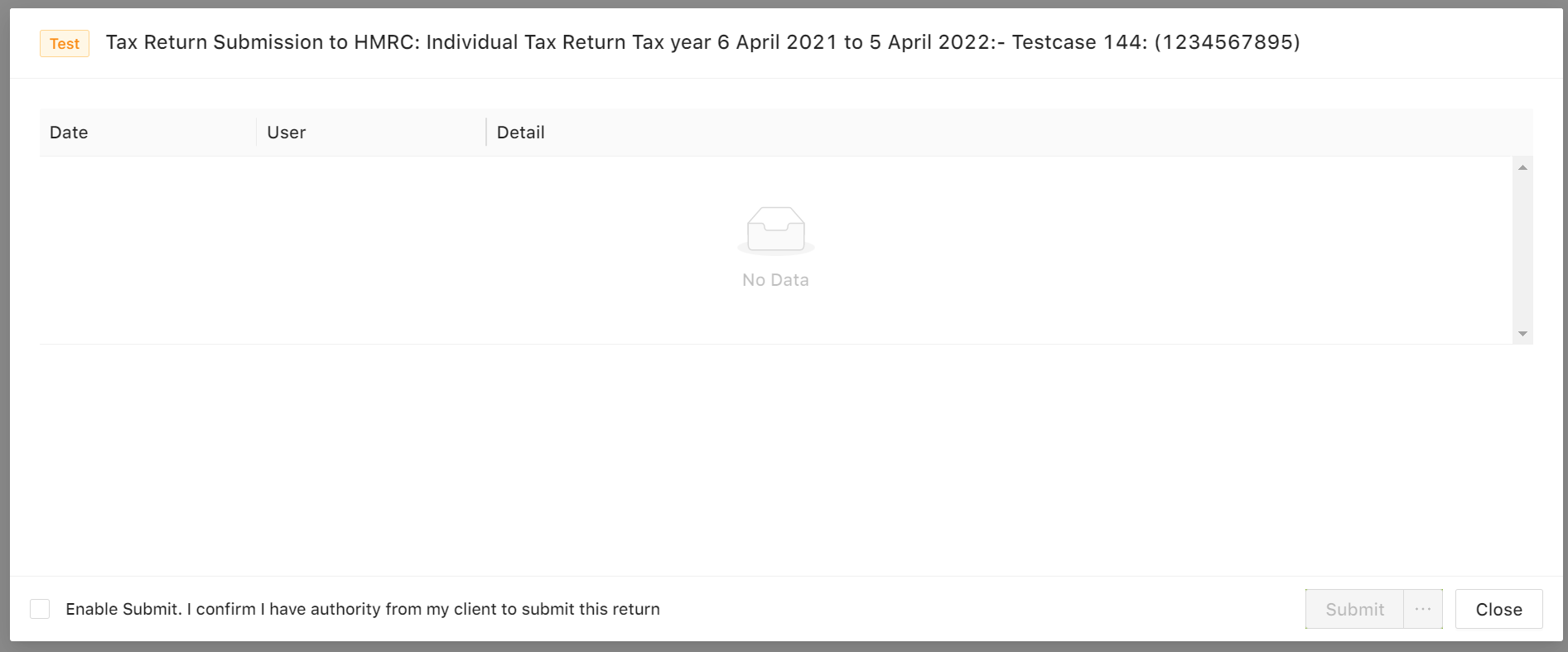

Submitting to HMRC

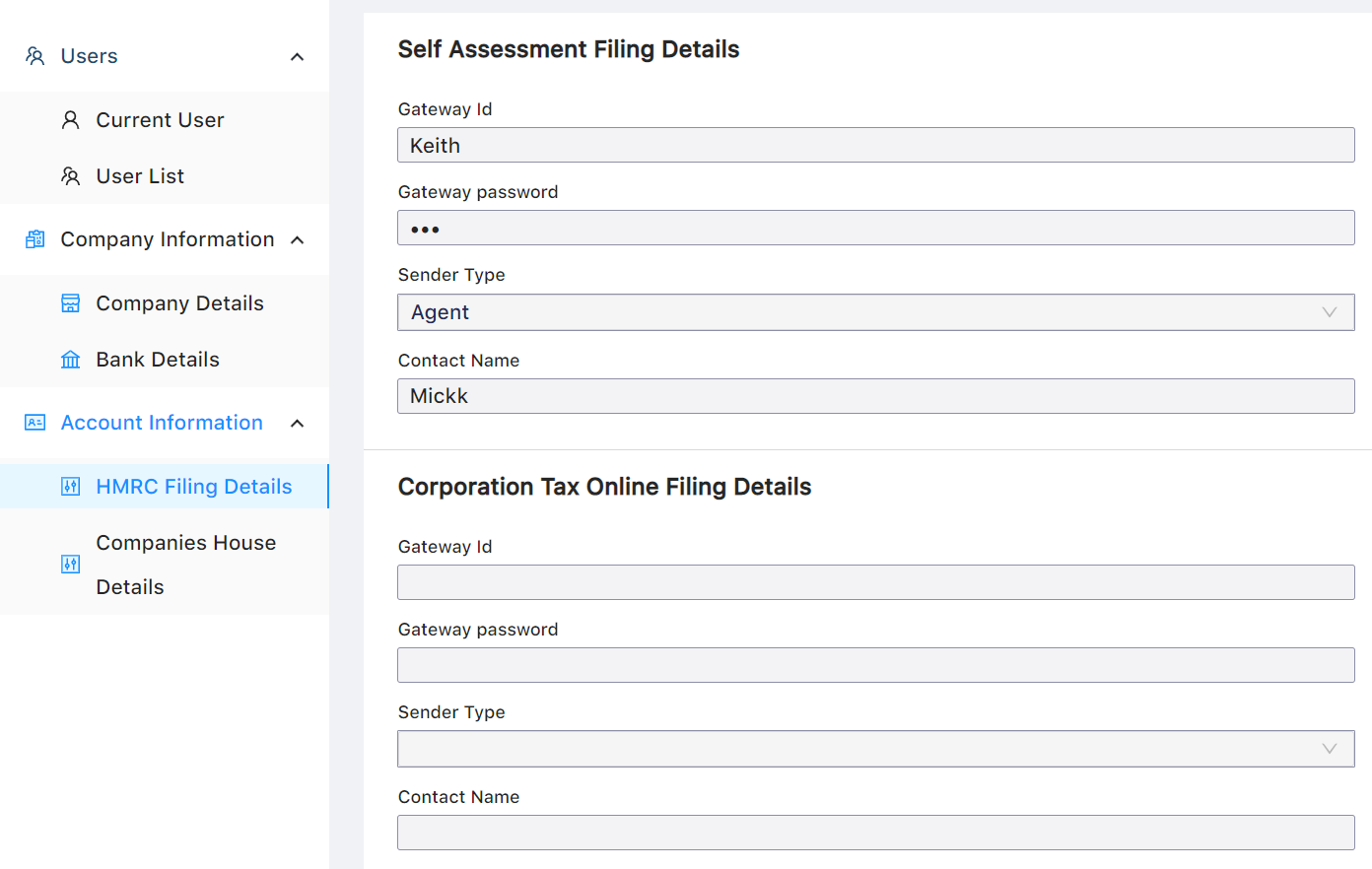

To file to HMRC you will need to go to Settings > Account Information > you can then fill in your HMRC Filing and Companies House details.

After filling in the relevant sections, you can select to send to client for review. Then finally you can Submit to HMRC.

Settings

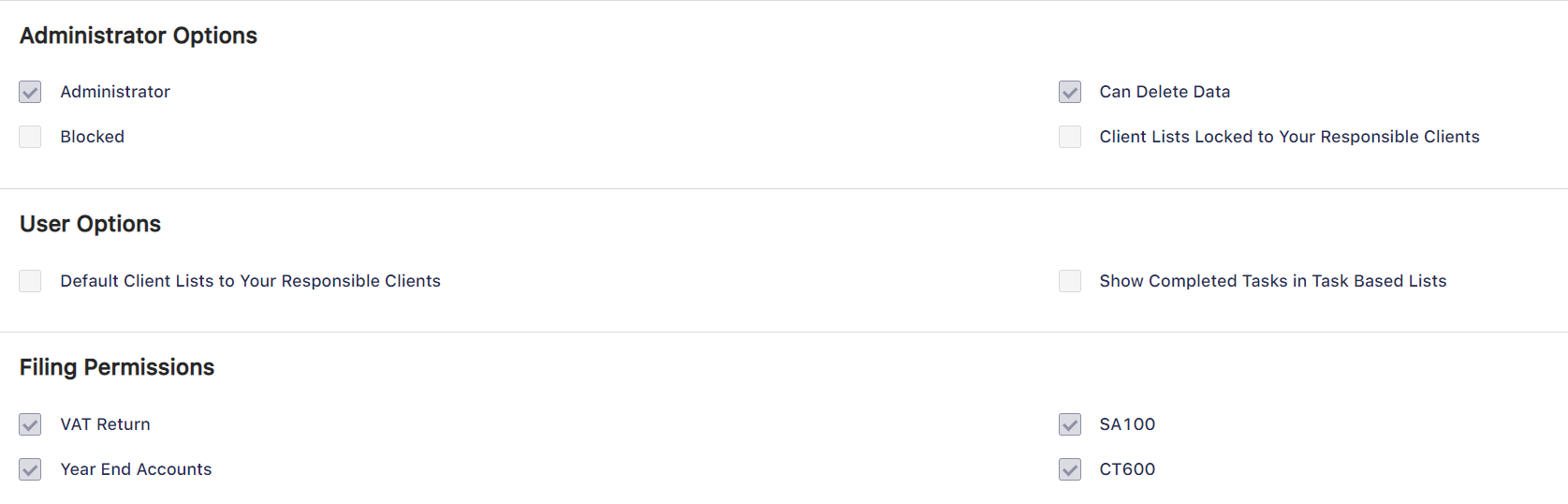

From here you can edit your user details, add new users and your company or account information.

When adding a user you can define what filling permissions they have and any additional options.