Powerful bridging software for Making Tax Digital, bringing you easy MTD compliance.

Fully-featured

Making Tax Digital software

BTCHub is designed to enable accountants and businesses to comply with Making Tax Digital VAT software rules quickly and effortlessly. The Software allows the creation of Making Tax Digital returns from multiple sources, including Group VAT capability.

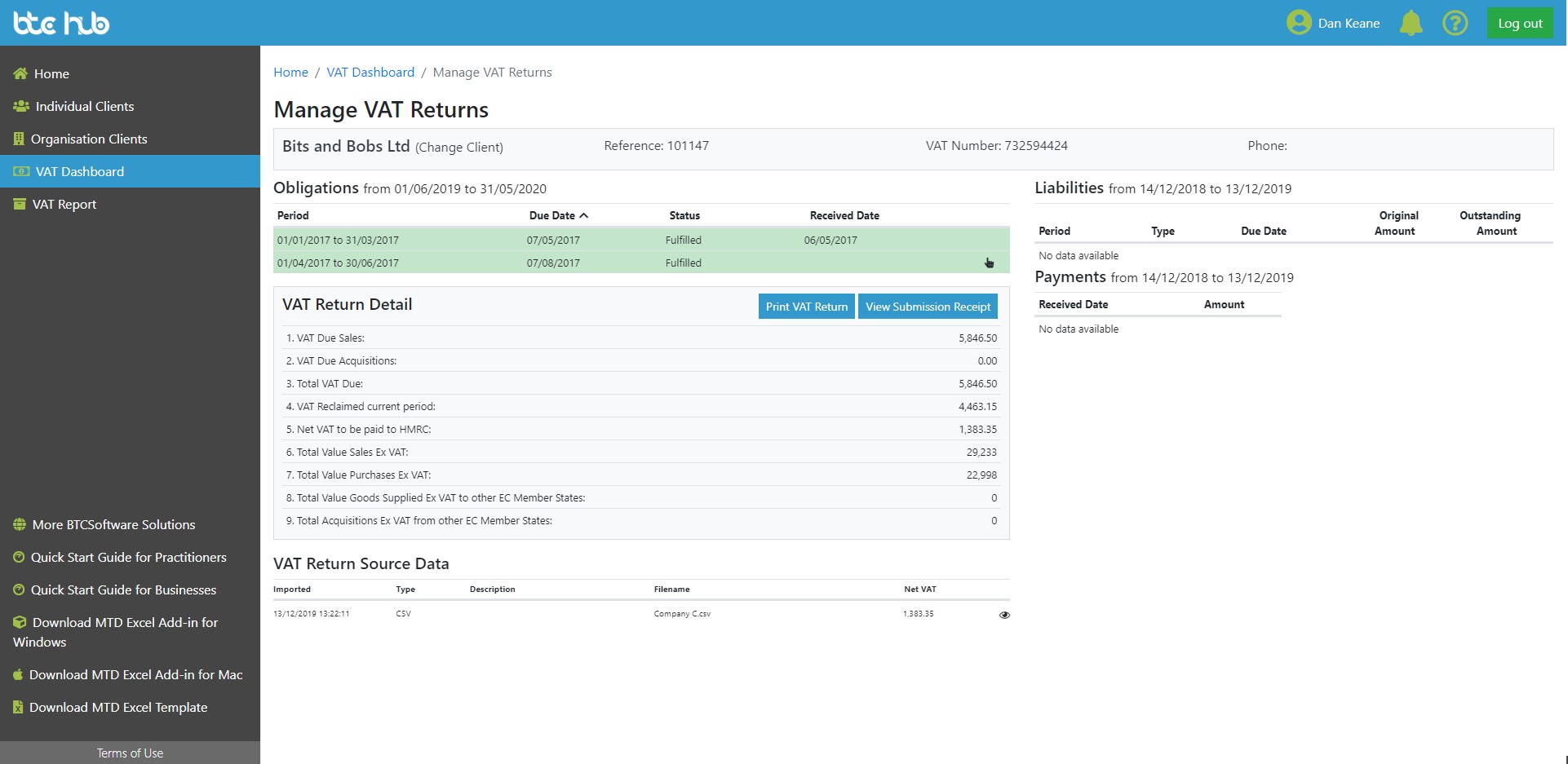

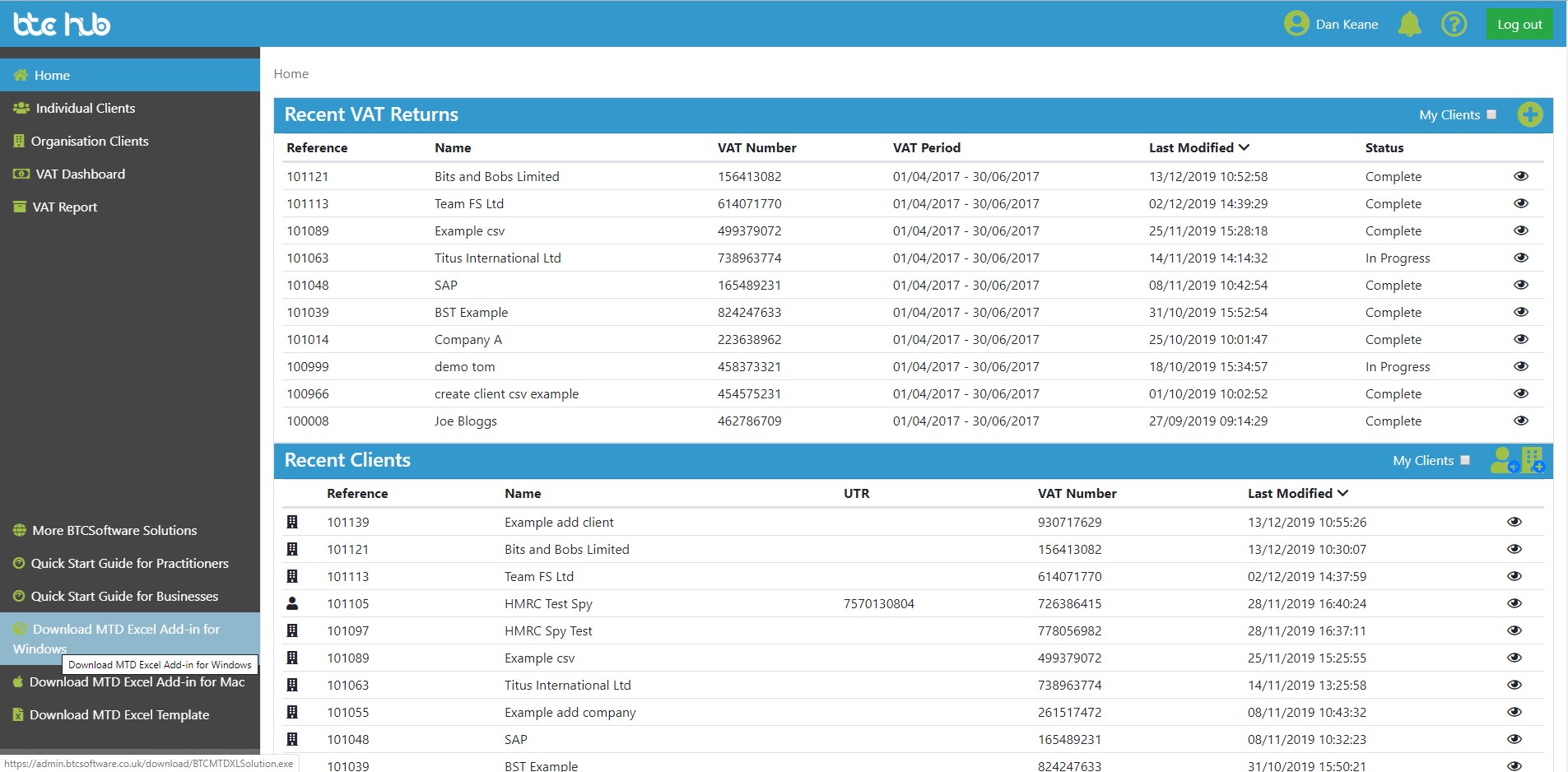

Making Tax Digital Software provides a comprehensive dashboard view of clients, obligations, and returns gives you complete control over MTD. Plus the Making Tax Digital bridging software is Excel and spreadsheet friendly and works with your existing bookkeeping software.

User-friendly and time-saving MTD software

BTCHub allows you to make the change to follow Making Tax Digital software HMRC rules with minimal impact on your current systems. Use the handy Excel add-in to submit your digital VAT return via the bridging software for Making Tax Digital, or import your data from multiple bookkeeping sources with the user-friendly import feature. Save time with the software by creating a Group VAT return from imports from a variety of systems, all in one place. With our making tax digital software you’ll be more time efficient and productive throughout the busiest tax periods.

For Agents, authorisation with HMRC is quick and easy, replacing the old 64-8 HMRC form.

Why pay for Making Tax

Digital Software?

Free software for Making Tax Digital is available on the market, but BTCHub provides many benefits that free of charge options cannot. One major drawback of free Making Tax Digital software is a lack of support. When you are submitting returns on a deadline, you want to be sure that any issues will be resolved with zero fuss. Included with BTCHub is access to the BTCSoftware UK-based support team on the phone at no additional cost. All of this means that with making tax digital software you can be confident in BTCHub and the service provided.

Making Tax Digital free software isn’t always updated with new tax details quickly, and you need to know that your software is up-to-date and fully compliant. BTCSoftware’s teams keep an eye on HMRC tax developments and ensure the software is current and updated.

What is Making Tax Digital

bridging software?

Making Tax Digital bridging software for Excel allows you to continue using your current bookkeeping systems to meet MTD for VAT rules. BTCHub works by linking your bookkeeping system to HMRC, including Excel spreadsheets. HMRC approves the Making Tax Digital bridging solution as a method of digitally linking your data to your VAT return, enabling easy MTD compliance.

Making Tax Digital FAQs and Support

BTCSoftware looks after its customers with top quality support, including a comprehensive database of frequently asked questions and helpful how-to videos on YouTube.

How do I purchase BTCHub?

To buy BTCHub, please visit our product page and choose the correct version for your company or practice. Once you have purchased your version, you will receive an email with all the details to get started, including your VAT receipt and secure login details.

You can also call our friendly consultants on 0345 241 5030 to find out more and sign up to BTCHub.

With which bookkeeping software does BTCHub integrate?

BTCHub integrates with most major bookkeeping software and accepts files in CSV format. You can also use our template to maintain digital records and our add-in to export from Excel to BTCHub.

Will bridging software be compliant after the soft landing period?

HMRC confirms that bridging software remains compliant after April 2021. That means that if you’re our customer using BTCHub, you will not have to look for alternative software to complete your VAT returns under Making Tax Digital rules.

To find out more about BTCHub and how bridging software works, check our blog.

Can I use spreadsheets to keep my digital records and submit MTD for VAT returns?

Yes, you can. HMRC has confirmed that spreadsheets are a valid form of digital recordkeeping under Making Tax Digital for VAT rules.

BTCHub provides the digital link between your records and HMRC.

Are there any MTD for VAT exemptions?

It is possible to apply for an exemption from HMRC if:

- You cannot use computers, software, or the internet because of your age, a disability, or where you live

- You object to using computers on religious grounds

Automatic exemption applies if:

- You’re already exempt from filing VAT Returns online

- Your taxable turnover is below the VAT threshold

- You or your business are subject to an insolvency procedure

2023 penalties reform information

From gov.uk:

Taxpayers will receive a point every time they miss a submission deadline. HMRC will notify them of each point. At a certain threshold of points, a financial penalty of £200 will be charged and the taxpayer will be notified. The threshold is determined by how often a taxpayer is required to make their submission.

When a taxpayer has reached the relevant threshold, as determined by their submission frequency, a penalty will be charged for that failure and every subsequent failure to make a submission on time, but their points total will not increase.

The penalty thresholds will be as follows:

| Submission frequency | Penalty threshold |

|---|---|

| Annual | 2 points |

| Quarterly | 4 points |

| Monthly | 5 points |

Benefits of BTCHub

Browser-based

Browser-based MTD for VAT software for easy access, wherever you are.

Compliant

Compliant with HMRC legislation on Making Tax Digital for Agents and Businesses and always up-to-date.

Report Centre

VAT Report centre provides control over submissions.

Dashboard

A dashboard view of obligations, return payments, and receipts.

CSV Imports

Easy CSV imports from your bookkeeping provider.

VAT Accounts

For Agents, a dashboard view of your clients’ VAT accounts.

Group VAT

Group VAT feature makes it easy to create a return from multiple sources.

Validates & Submits

Giving you peace of mind that you are Making Tax Digital compliant.

Quick authorisation

Quick online authorisation for Agents to replace the old HMRC 64-8 forms.

Templates

Excel and spreadsheet friendly, with a template provided to help you get started.

Easy to get started &

free unlimited technical support

BTCHub is browser-based software, so you can easily access it from any computer with an internet connection. It works with Windows and Mac systems. Getting started is as easy as logging in with your secure account details. Plus, BTCHub integrates with Solution Cloud.

- Easy to follow user guide

- Free technical support