Integrated Individual Tax Software using SA100 forms and direct filing

Individual Tax Return software

for easy Self-Assessment

Linked with our Accounts Production and Tax Return software, this module gives you an easy, quick solution to filing Individual Tax Returns to HMRC.

It integrates with our other Self-Assessment modules to create a streamlined process for Tax Returns with HMRC-approved software and online filing.

Meet your deadlines with

intuitive tax software

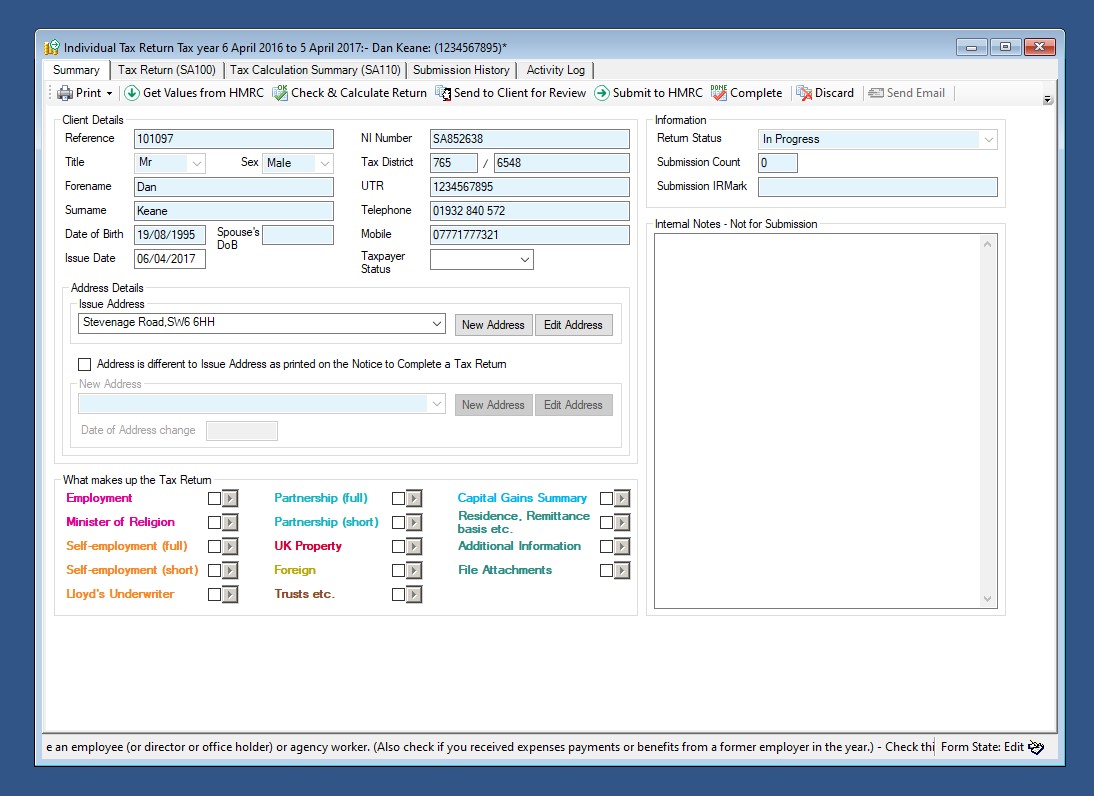

Our Self-Assessment tax software is designed to create efficiency for accountants. The intuitive layout provides HMRC guidance notes within the context of your current task. Individual Tax Returns feature our pre-submission validation tools to avoid errors before you submit the SA100 forms to HMRC online.

Use the task reminder feature of Practice Management Core to reduce the risk of late Tax Return filing penalties. The software helps you prevent delays or penalties due to accidental errors with its check-and-generate process ahead of sending the Individual Tax Return to HMRC.

Financial data is drawn from Accounts Production or easily input, and client data pre-populates from Practice Management Core to speed up your tax work and administrative errors. Built-in reports make it simple to understand and analyse your Self-Assessment activities and commitments.

Individual Tax Return

Key Features

Accelerated Individual Tax Returns with online filing

Individual Self-Assessment SA100 forms, including Scottish rates. File directly to HMRC without leaving the software

Time-saving integrations

Links with the trial balance using our Accounts Production software provide efficiency when adding financial information

Link Partners with Partnerships

Adding BTCSoftware’s Partnership and Trust Tax Return software gives you quick and accurate completion of Partner Tax Returns

Easier Capital Allowances

Built-in and comprehensive Capital Allowance Calculator for easier claims

Your data in one place

Efficient and accurate population data from information held in PM Core

Handle multiple clients with ease

A powerful option for practices of all sizes, designed to make Self-Assessment easy for multiple clients

Reduce data entry with HMRC integration

Pre-populate Tax Returns with client data already known by HMRC

Stay on track using built-in reminders

BTCSoftware’s reminder system helps you avoid the risk of late penalties when you’re filing for many clients

Easy to install &

free unlimited technical support

All of our software is simple to install for network or standalone installations and is also available in a cloud-based option.

- Simple install pack for network or standalone installations

- Cloud installation via our technical team

- Useful quick-start videos

- Simple transfer of standing data

- Unlimited telephone and email support included