Award-winning Self-Assessment tax software that accelerates you through Individual, Partnership and Trust tax returns. Find out more about our Self Assessment Software below.

Self-Assessment Tax software

that boosts your efficiency

Our highly popular, user-friendly self-assessment tax return software has been designed specifically for accounting, finance and tax professionals who prepare multiple tax returns for UK Individuals, Partners and Trusts.

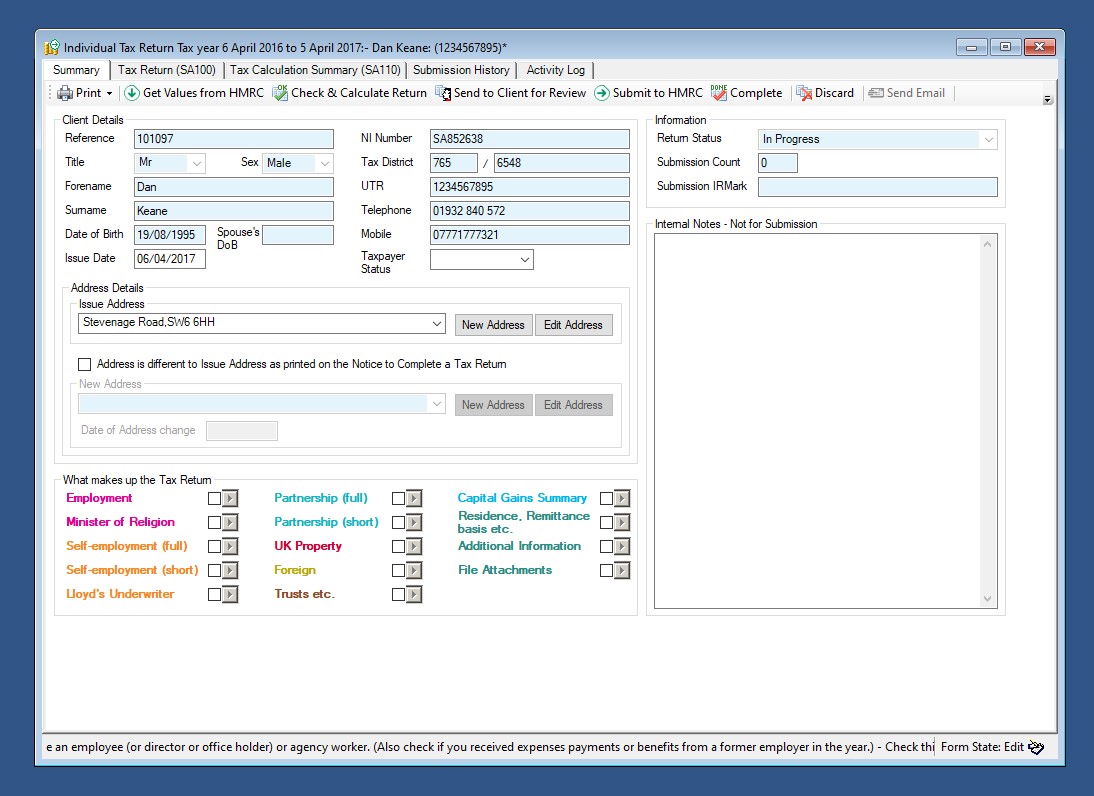

Get Self Assessment software for SA100 Individual Tax Returns that will enhance your practice, with links to add-on modules for Partnership and Trust Tax Returns.

What do previous

customers say about our Self Assessment Software?

BTCSoftware customers say they like our Self-Assessment tax software’s intuitive layout with context-sensitive HMRC guidance notes and the fact that all returns are validated before submission to reduce errors. Take care of Individual Tax Returns for your clients with time-saving links to Accounts Production, plus further functionality using our Partnership Tax Return and Trust Tax Return modules.

All of our tax return software includes a built-in task reminder system to reduce the risk of late penalties and pre-submission locks on individual returns to prevent accidental errors associated with sending unchecked Tax Returns to HMRC.

Data is simple to retrieve and review on-screen, and you can easily attach PDF files to any return. Reports generated by the software give a clear summary of all your Self-Assessment client activity.

Self-Assessment Tax Return

Key Features

Efficient Tax Returns with online filing to HMRC

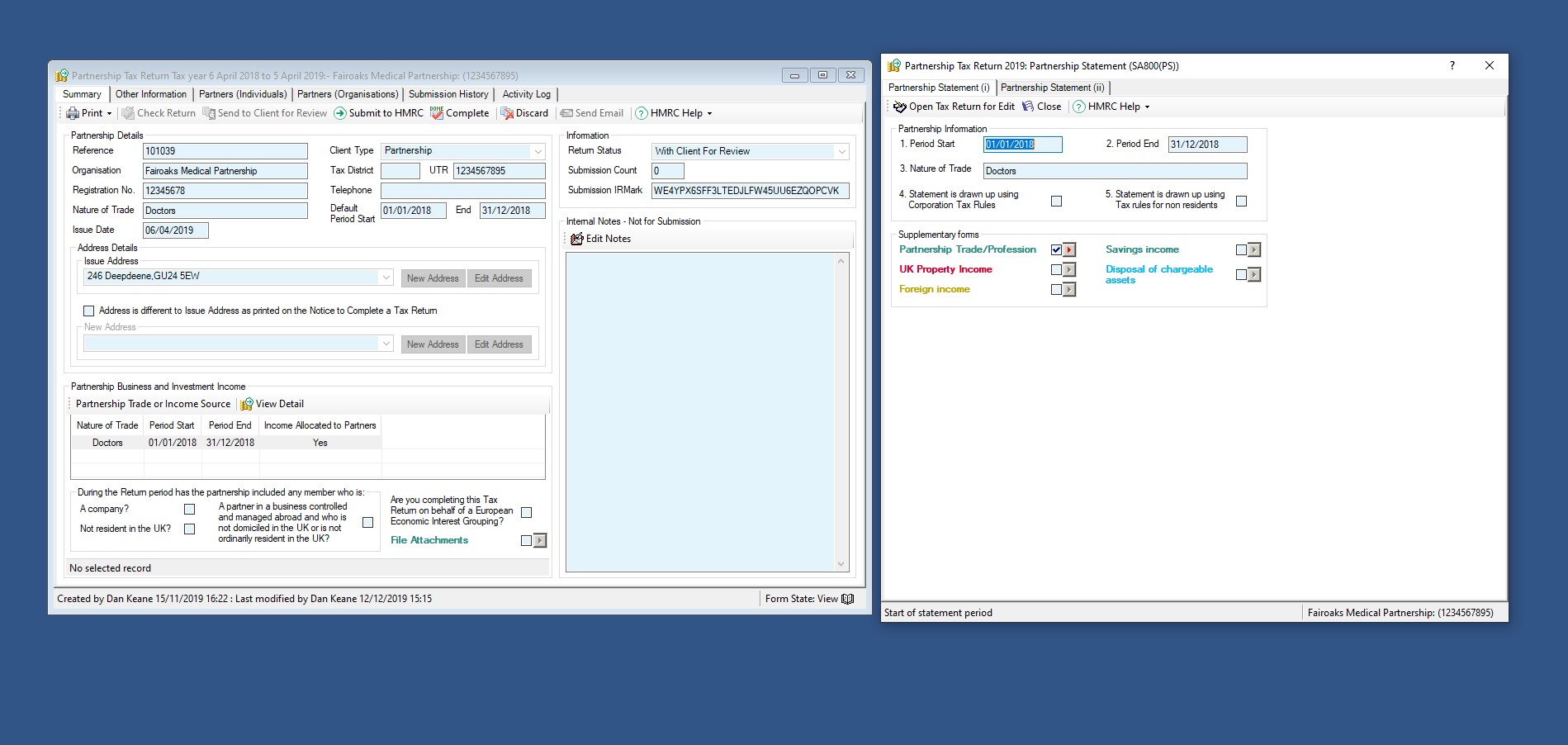

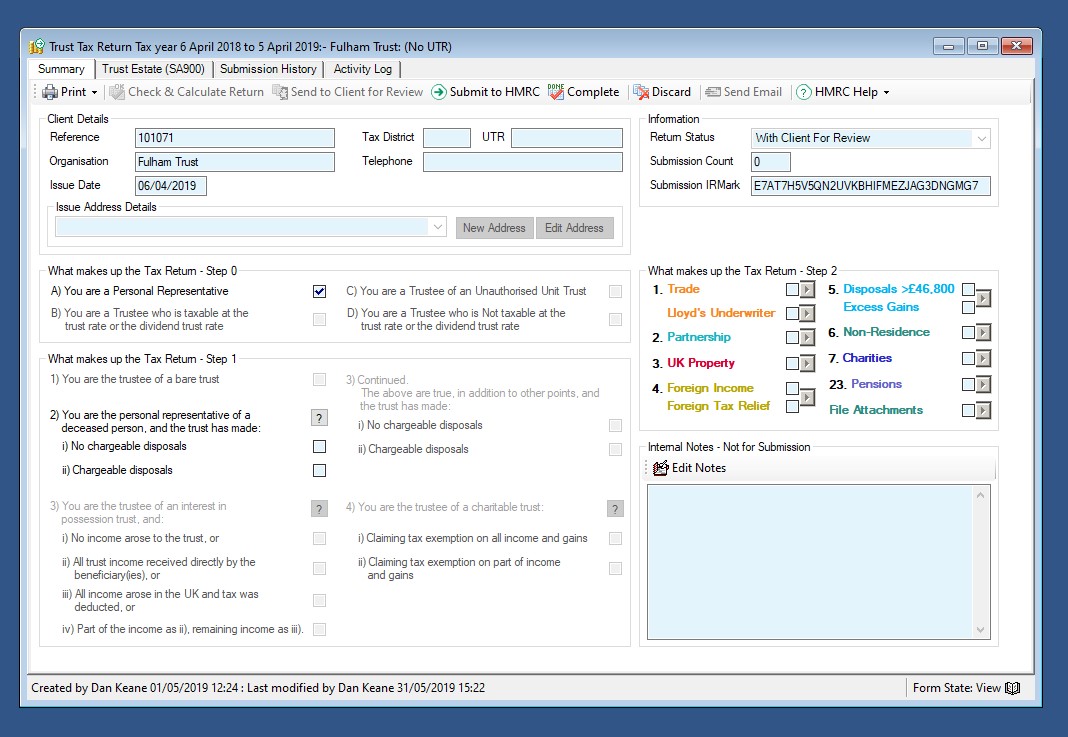

Individual (SA100) including SA302, Partnership (SA800), and Trust (SA900) Tax Returns, including Scottish rates

Easy integrations

Two-way integrations with many bookkeeping providers via Accounts Production make it easy to complete the tax return

Associate Partners with Partnerships

Automatic link between Partners in the Individual Tax Return and Trust Tax Return systems (SA100 and SA900) and Partnership (SA800) Tax Returns

Capital Allowance Calculator

Built into all of our Tax Return software, our comprehensive Capital Allowance Calculator makes claiming allowances painless

Save time

Auto-complete dates feature saves on data entry work

Fee-earner allocation

Allocate fees per client to track and maintain fee earner responsibility across Individual, Partnership and Trust Tax Returns

HMRC integration

Pre-populate individual tax returns with data already known by HMRC

Reduce the risk with built-in reminders

Self-Assessment Tax Software includes PM Core with a useful reminder system to avoid the risk of late penalties

Easy to install &

free unlimited technical support

Self-Assessment tax software is simple to install for network or standalone installations and is also available in a cloud-based option. Our award winning self assessment software enables you to effectively prepare your UK tax returns.

- Simple install pack for network or standalone installations

- Cloud installation via our technical team

- Useful quick-start videos

- Simple transfer of standing data

- Includes telephone and email support

Self-Assessment

Purchase Options

Annual product licences include unlimited support, together with free software updates.

Want a free trial?

Self-Assessment is available to trial, free of charge for 7 days! Simply click below to sign up.

Individual Tax Return

£191.10*

PM Core

All Features Listed Above

Annual Licence

Full UK Support

*starting from